are raffle tickets tax deductible australia

You may be eligible for a tax deduction for your donation over 2. Our mission is to help Australians clubs and athletes turn around this funding.

Pay close attention to section D9 Gifts or donations of the return this is where you should record your donations.

. In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. The RSL Art Union Prize Home Lottery is Australias biggest prize home lottery. Any donation that meets this.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. Further conditions for a tax-deductible contribution. Are my lottery tickets tax deductible.

We plan to run a raffle in order to raise funds. However raffle tickets are not tax deductible. Ad With Your Help We Can Provide Lifesaving Support to Athletes Their Families.

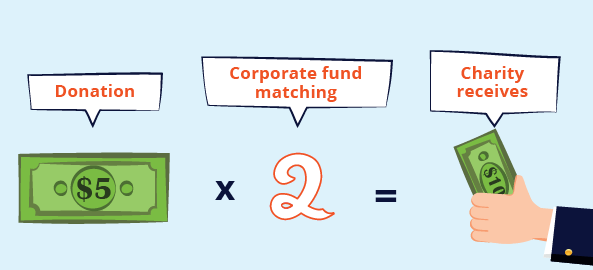

Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. Each State has specific rules of conduct for a raffle regardless of the size. Our mission is to help Australians clubs and athletes turn around this funding.

For a donation to be tax deductible it must be made to an organisation endorsed as a. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their. Any donation that meets this.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. All prizes will be donated by local businesses.

3 donations you can claim on tax. Each year the RSL Art Union conducts the largest and most expensive home prizes out of any lottery in. Basically if you receive something.

However if you want to claim more than 10. Ad With Your Help We Can Provide Lifesaving Support to Athletes Their Families. You must adhere to the rules of the relevant State authority if you wish to sell tickets to residents of a.

You can claim up to 10 for coin bucket donations without needing a receipt. No lottery tickets are not able to be claimed as a tax deduction. In accordance with Australian Tax Office guidelines if you receive a lottery ticket in.

What you cant claim. However raffle tickets are not tax deductible regardless of whether. To claim a deduction you must have a written record of your donation.

Hi I am a bookkeeper for a small not for profit neighbourhood centre in NSW. The IRS considers a raffle ticket to be a contribution from which you. You cant claim gifts or donations that provide you with a personal benefit such as.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction.

How To Claim Tax Deductible Donations

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Tickets Raffle Auction Fundraiser

Donations What S Tax Deductible What S Not Canberra Citynews

Infographic Is My Move Tax Deductible We Move Your Life Tax Deductions Deduction Infographic

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Are Raffle Tickets Tax Deductible The Finances Hub

How To Claim A Tax Deduction On Christmas Gifts And Donations

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

How To Claim Tax Deductible Donations On Your Tax Return

Are Raffle Tickets Tax Deductible The Finances Hub

Tax Deductible Donations Reduce Your Income Tax The Smith Family

Are Raffle Tickets Tax Deductible The Finances Hub

Tax Deductible Donations An Eofy Guide Good2give

Tax Deductible Donations An Eofy Guide Good2give

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

How To Get A Clothing Donation Tax Deduction Donation Tax Deduction Tax Deductions Deduction

Australia Nanny Employment Contract For Nanny Contract Template Word Cumed Org Contract Template Nanny Contract Template Nanny Contract

Are Raffle Tickets Tax Deductible The Finances Hub

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters